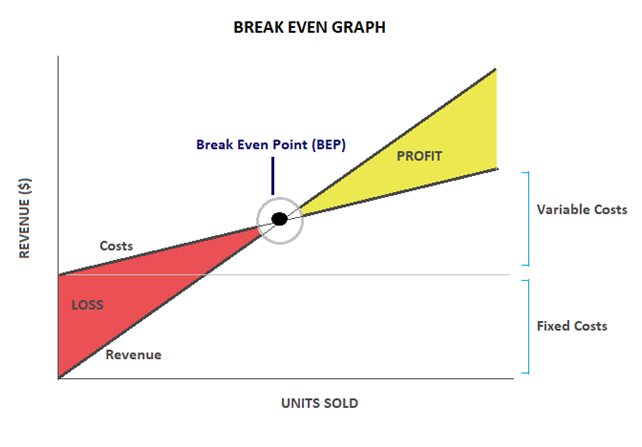

If you have just started growing your company, you might be asking yourself "When does my company break even? What is the right price for my product? Should I charge more or less?" To answer these questions, you have to start with the basics – a simple financial analysis and calculating your break even. Overall, the Break Even Analysis Calculator is a powerful tool that empowers businesses to make data-driven financial decisions, set achievable goals, and ensure long-term financial sustainability.Formula - Break even point in a nutshell Use the following formula to calculate break even point: Break-even point formula (unit sales)īreak even quantity = Fixed costs / (Sales price per unit – Variable cost per unit) Break-even point formula (sales dollars)īreak-Even Point (sales dollars) = Fixed Costs ÷ Contribution Margin Why do you need these formula?įor new businesses, reaching a break-even point is a critical milestone insuring a business can cover its total expenses and is at a point to start making a profit. The calculator highlights the impact of variable and fixed costs on profitability, encouraging businesses to optimize their cost structures and identify areas for cost reduction. It demonstrates a clear understanding of the company’s cost structure and growth potential. The break-even analysis is a valuable tool for communicating financial viability to potential investors. Performance Evaluationīy regularly monitoring the actual sales against the break-even point, businesses can assess their financial performance and make necessary adjustments to improve profitability. It helps in identifying the sales volume required to offset potential losses. Understanding the break-even point enables businesses to evaluate the risk associated with new projects or ventures. It provides insights into the financial implications of different scenarios.

/break_even_point.png)

The calculator helps businesses make informed decisions about product launches, expansions, cost reductions, and other financial matters. They can adjust their pricing strategies to meet financial goals and remain competitive in the market. Pricing Strategyīy knowing the break-even point, businesses can set competitive yet profitable prices. The calculator aids in developing accurate financial projections, allowing businesses to set realistic sales targets and plan their budgets effectively. How Break Even Point Calculator Helps Businesses? Financial Planning and Budgeting: Want to know more about ERP Features and our Services? Output: The calculator provides the break-even point, which can be presented in the form of the number of units or the dollar amount of sales needed to break even.

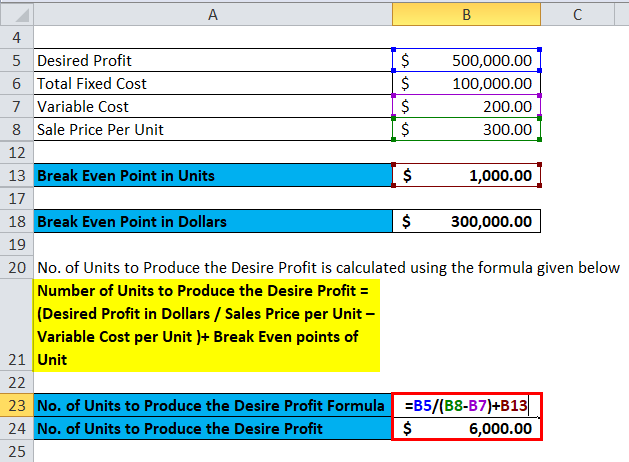

Calculation: The calculator uses the input data to perform the break-even analysis using the formula: Break Even Point (in units) = Fixed Costs / (Selling Price per Unit – Variable Costs per Unit)If the user wants the break-even point in dollars, the formula becomes: Break Even Point (in dollars) = Fixed Costs / Contribution MarginThe “contribution margin” represents the difference between the selling price per unit and the variable cost per unit.Variable Costs per Unit: The costs that vary with the level of production or sales (e.g., raw materials, direct labor, commissions).Selling Price per Unit: The price at which each unit of the product or service is sold.

Fixed Costs: The total amount of expenses that do not vary with the level of production or sales (e.g., rent, salaries, utilities).Input Data: The user enters the following information into the calculator:.How the Break Even Analysis Calculator Works? This calculator utilizes the fixed costs, selling price per unit, and variable costs per unit to compute the break-even point, providing valuable insights into a company’s financial health and sustainability.

The Break Even Analysis Calculator is a financial tool that assists businesses in determining their break-even point-the level of sales or revenue needed to cover all costs and expenses, resulting in zero profit or loss.

0 kommentar(er)

0 kommentar(er)